What Insurance Does

Dave Ramsey Recommend?

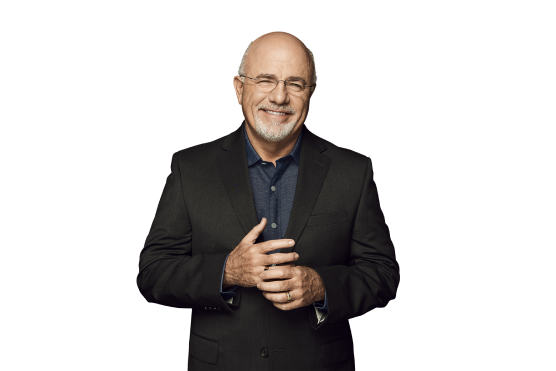

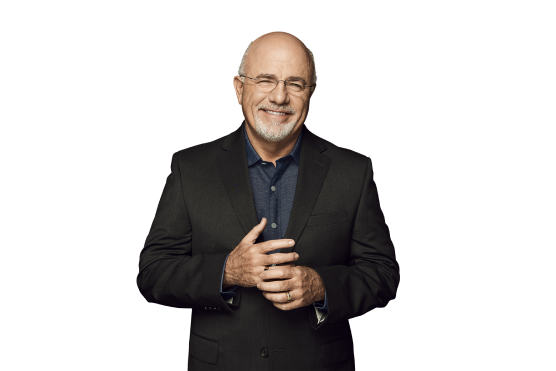

I recommend Zander Insurance from experience. I know they are a principled, debt free company offering insurance programs directly in line with my recommendations.

- Dave Ramsey

What Dave Ramsey Recommends for Term Life Insurance

If you have family members that depend on your earnings, you need life insurance. How else will they replace your income and avoid being left with debt? Dave Ramsey recommends term insurance as opposed to whole life, variable life or universal life insurance. These cash value policies are often a better deal for the agent than the insured, and they eat up extra money that could be put to better use accumulating your nest egg. With the money saved on term insurance, you can attack debt and grow your assets to the point where you don't need life insurance at all. Dave recommends a policy amount of 10-12 times your annual income with a 15- to 20-year term, or up to 30 years for younger families.

Which Insurance Company Should I Select?

You should choose the company that offers the least expensive, no-gimmicks term life insurance policies. Avoid cash value policies or policies with an attached savings plan. There are many lesser-known, low-cost companies with first-rate policies and service. You may not have heard of them, but we know which ones they are and will help you make the best selection for your specific needs.

How Long Should I Be Tobacco Free To Qualify For Non-Nicotine Rates?

The required length of time is varies by insurer, although 12 months is typical to qualify for a non-tobacco rate. Zander Insurance is familiar with these rules and can work with you to get an affordable rate regardless of your tobacco status.

Should I Have Child Riders On My Policy?

If you are going to insure your children, yes, you should. Dave discourages taking out a separate child policy to establish a savings plan or to guarantee they'll be insurable as adults. A rider that covers all children in the family, up to adulthood, is only about $50-$60 each year for $10,000 in coverage. Coverage goes as high as $25,000. Age and health restrictions vary by insurer.

Is It Important That I Have Living Benefit Riders On My Policy?

Dave doesn't consider them important, and they tend to cost more than they're worth. Riders such as critical illness, living benefit and accidental death are essentially gimmicks. They earn income for the insurance company and commissions for the agent, but they don't do that much for you.

Why Do I Need Life Insurance?

If there's someone who would suffer financially if you were gone and your income disappeared, you need life insurance. If you're single and don't have dependents, there's generally no need for insurance, although you might consider it if you don't have enough money saved to pay your burial costs and other final expenses.

You can explore more information about what Dave recommends for IDT theft protection, home insurance, auto insurance and disability insurance.