What Insurance Does

Dave Ramsey Recommend?

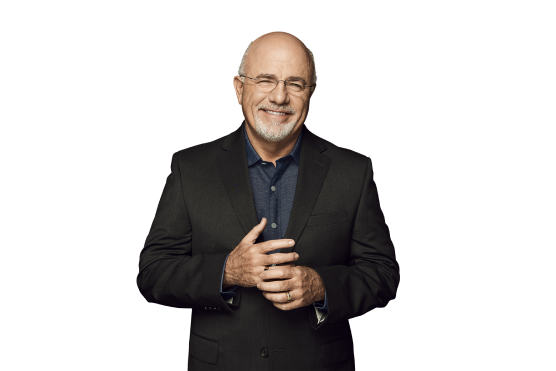

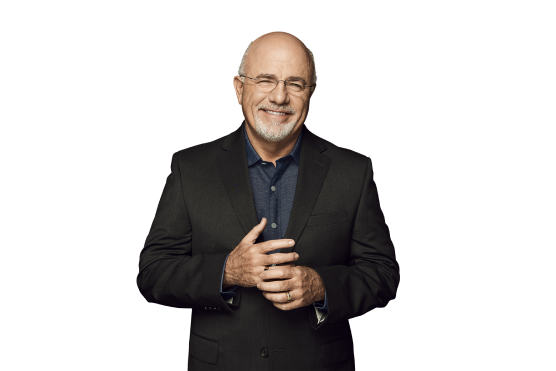

I recommend Zander Insurance from experience. I know they are a principled, debt free company offering insurance programs directly in line with my recommendations.

- Dave Ramsey

What Dave Ramsey Recommends for Disability Insurance

Dave recommends getting coverage equivalent to 60-70% of your monthly income. To avoid overpaying for insurance, he also suggests that you choose the longest elimination period your emergency fund and budget can handle. The important thing is that whether you've just saved your first $1000 or have your 3-6 months of expenses saved for a rainy day, you can comfortably pay the bills without risking your family's security. He also recommends you opt for a benefit period of up to age 65 or more if you can afford it, but a 5-year benefit period would be the minimum suggestion.

Dave has said that you should get long-term disability coverage through your employer if they offer it. This option will usually allow you to get better coverage for the least money. But for those who don't have this option, we can help you with cost-effective disability insurance solutions with the right amount of coverage to meet your needs.

How Much Disability Insurance Do I Need?

Start with that 60% to 70% of your monthly income that Dave Ramsey recommends. You probably won't have to live on rice and beans to cover your expenses with this amount. However, as you pay off your debts and increase your rainy day fund, you can reduce your coverage and experience the financial freedom of being partially self-insured.

How Long Should My Benefit Period Be?

A benefit period is the amount of time you'll receive payouts once they begin. For long-term disability insurance, Dave Ramsey suggests a benefit period of at least 5 years and up to age 65 if you can cover that financially. You may be wondering what will happen after those 5 years? The truth is that 85% of disabilities resolve themselves within 5 years. By that time, your disability may be gone or you may have taken up a new occupation you can perform with the disability.

How Long Should My Elimination Period Be?

An elimination period is how long you must wait after you've become disabled for your disability payments to begin. You don't want to overpay for insurance. If you can comfortably sustain yourself for 3, 6, or 12 months, it's generally better to only buy as much insurance as you need. Dave recommends that you not pay more for insurance than you have to, so a 90-day or 180-day elimination period is suggested.

Should I Consider Any Riders?

Most riders don't do much to actually increase your overall protection in the event of a long-term disability. They end up driving up the insurance costs for people who only demand the best of the best, which is generally more than they need. Dave doesn't recommend any additional rides, which he considers over-priced and unnecessary. In most cases, they benefit the insurer more than the insured. At Zander, we agree with Dave in that we'd rather see you get the right amount of coverage rather than too much or too little.

Why Do I Need Life Insurance?

If there's someone who would suffer financially if you were gone and your income disappeared, you need life insurance. If you're single and don't have dependents, there's generally no need for insurance, although you might consider it if you don't have enough money saved to pay your burial costs and other final expenses.

You can explore more information about what Dave recommends for term life insurance, IDT theft protection, home insurance, and auto insurance.